Disclaimer: This is not investment research, and you should not consider it as such. It is commentary based on publicly available information. I have a very material personal interest in S&U Plc shares. A portfolio I help to manage has a very large weight in S&U Plc shares. Hence, I cannot help but be biased. Please do your own work – my projections are mine alone.

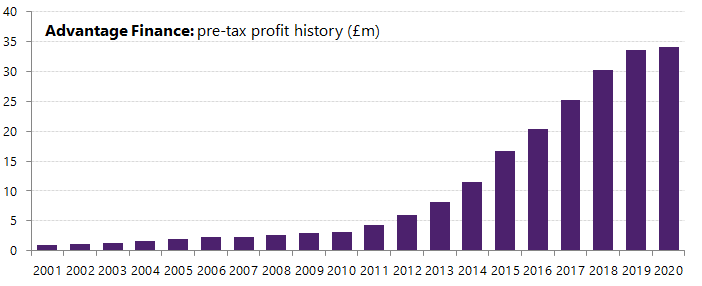

I first wrote about S&U, the specialty finance business, two years ago. In that time the stock is up about 10%. This is a failure in performance terms – my hurdle rate is a lot higher than that – though I’ve received ~10% extra in dividends in that time.

Fundamentally, though, it’s far from being a failure. In fact, it’s been an unmitigated success:

- I had projected that the company would earn £22.9m in 2022. They actually earned £38.0m.

- I thought they would earn £30.2m in 2023. Brokers currently forecast that they’ll do £32.6m, 8% higher, and I’m pretty sure they’ll beat that.

- I thought they would earn £34.4m in 2024 and, again, I now suspect it’ll be more like £37-38m.

It’s not as if I was setting easy targets, either. My forecasts, at that time, were way ahead of the market. The sell-side was, predictably, panicking about economic impacts and doing what they do best – extrapolating short term trends indefinitely into the future.

We did have a brief interlude of sanity in this journey. S&U ran up from ~£16 to ~£29, but we’ve ended up right back where we started: with the market terrified that S&U’s days are numbered. It is the energy price crisis and the impending recession which has spooked everyone now.

This is a business which, I need not remind investors, grew profits through the GFC. That’s right – it’s a non-prime financial business that grew profits through the worst recession in living memory. Average net profit for 2021 and 2022, the two COVID-impacted years, was £26.3m: within spitting distance of the £28.4m they made in the two prior years. They are more resilient than the market gives them credit for.

You don’t even have to take my word for it: they released a trading update a few weeks ago, noting that:

“Although it is only just over two months since our last trading update, S&U is pleased to report that both its motor and property bridging divisions continue to outperform its expectations, both in transactions growth, and in the quality of its book and the new business it is writing. Current Group receivables now stand at approximately £370m against £340m in May, and profitability exceeds that of H1 last year. “

H1 last year was their best H1 ever. They are now beating that. The business is – if you’ll forgive the pun – motoring.

You have visibility for continued growth, too: those £370m of net receivables compare to £322.9m at the start of the year. Like any finance business, the more you lend, the more interest you earn. Without wanting to oversimplify, this is an excellent indicator that earnings will keep going in the right direction.

And I know, I know what you’re thinking: Lewis, it doesn’t matter that the business is growing. We’re about to go into a recession! Consumers are going bust! The energy crisis will cripple everyone!

Well… maybe. As I said, S&U’s average profits in the two-COVID impacted years were pretty similar to their prior profits. Anyone who tells me with a straight face that the current situation is as apocalyptic as a total shutdown of society is, in my view, completely bonkers.

Investors, who overwhelmingly come from quite a narrow strata of society, tend to have a rather fixed view of the sort of people who take out non-prime car loans. Obviously, they muse, they must be living hand to mouth, paycheck to paycheck, struggling to keep their heads above the parapet, with zero flexibility in their budgeting.

It’s a patronising assessment, frankly, and it’s also completely wrong. If you look at S&U’s historic results, you will see that the only thing that severely damages their repayment trends is rising unemployment. When people lose their jobs, they stop paying for their car, because they have no choice. If they have a job – and they need their car to get to work – they pay for it. People find a way to cut back and make priority payments.

This is, of course, leaving aside the fact that in the next six weeks we will get a bazooka of cash blasted at the people of Britain. Relief from record energy bills is too popular, and too politically attractive, not to happen. It is also – frankly – the right thing to do, unless we want to live with massive economic scarring from what is (hopefully) a temporary phenomenon.

Continue reading“S&U Plc – Can’t Get No Love”