Disclaimer: I have a material personal interest in Macfarlane shares. A portfolio I help to manage has a large weight in Macfarlane shares. Hence, I cannot help but be biased. Please do your own research – my projections are mine alone.

How I Invest

As I described in my year-end post, to the extent I have a framework in investing, it is this:

- Buy companies which are cheap in absolute terms, and in any case cheaper than the market

- … which are more predictable than the market

- … which are higher quality than the market (as judged by prospective return on invested capital)

- … and have better growth prospects than the market

My order of priority is roughly as I’ve laid it out above.

To me, this is a common-sense way of investing. Look for cheap stuff which should be more highly valued.

So what determines whether a company should be highly valued? Why do some companies trade at 25x, and some at 5x?

Well, highly valued should come from a combination of:

- Predictability

- Bonds trade at lower expected returns than mature stocks, which have lower expected returns than start-ups

- The riskier an asset, the higher the necessary returns investors will demand , and the lower the ‘multiple’ the asset will trade on

- Quality

- The higher the returns on invested capital, the more a business is worth. A growing business is worth nothing if that growth requires a huge amount of uneconomic capital

- Growth

- Subject to the quality hurdle, more growth is better than less. Everyone knows fast growing business trade at better valuations

You can nuance this further. Some people would tell you that brilliant management or an aligned board should be prized. I agree. But these only matter to the extent they show through in one or more of the numbers above. Excellence at the top of a business should translate into excellence through the business and in the income statement.

Excellence in Action

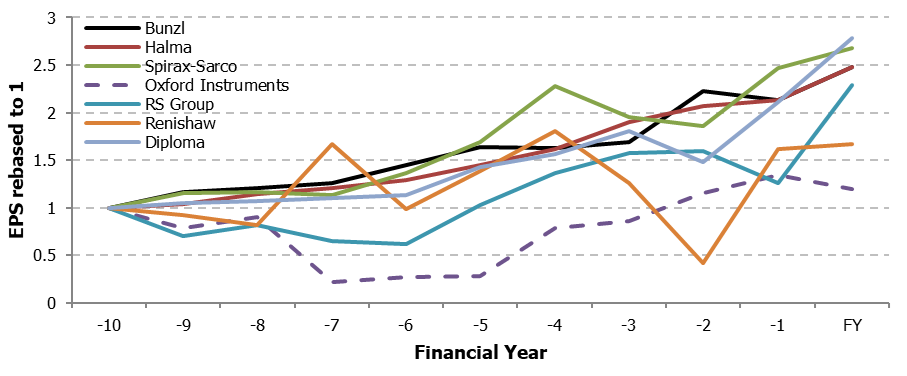

Sticking with this theme, let me take a cherry-picked sample of some UK industrial/distribution businesses: Bunzl, Halma, Spirax-Sarco, Oxford Instruments, RS Group, Renishaw and Diploma.

These are all high-quality mid-cap industrials. Each of them has a decade of good growth behind them, strong returns on invested capital, and a highly predictable P&L. None of them has lost money in the last decade. Look at the EPS progression in the chart below:

People are drawn to businesses like these because the numbers match their pre-conceptions. They think “scientific instruments must be a good business”, and the numbers bear it out. They consider that “distributing small, mission critical products must make for quite a reliable profit base”, and the figures chime.

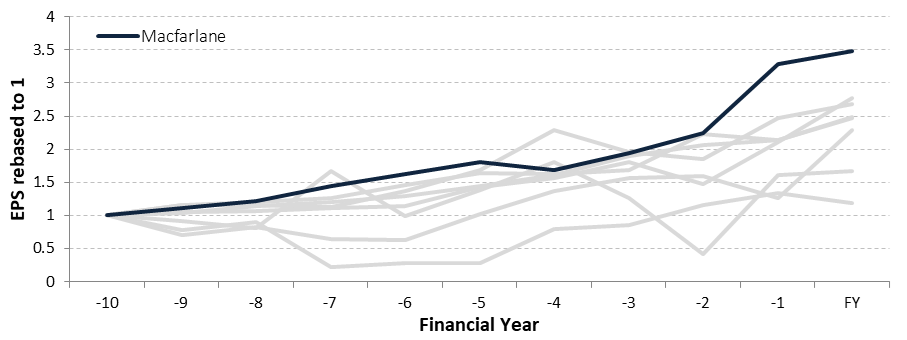

You already know where I am going with this. Take a look at the chart below, which shows the same businesses, but now includes Macfarlane:

Macfarlane sells packaging. The entire market grows or shrinks by a low single digit percentage point amount each year. It is irreplaceable and intrinsically tied to every factor of the physical economy. Macfarlane is the largest independent distributor of packaging in the UK.

For a much longer exposition on why I think Macfarlane is so good, read this. I wrote it a year and a half ago. The stock is now cheaper than then, but the business makes ~15% more money. You have an opportunity to get a much better entry than I did!

I think Macfarlane looks a lot like the businesses I highlighted earlier. In some ways it is worse; return on capital and margin is slightly lower, as shifting packaging around is inherently a more competitive business than (for instance) producing scientific instruments. In some ways it is better; packaging is about as non-cyclical as it gets, and revenue and demand is very easy to forecast, with little lumpiness and no customer concentration.

So, here’s the rub. Look at this comparison table:

Macfarlane has better EPS growth and a similar return on equity compared to the pack (which, in my view, is understated because of the conservatism of their accounting).

It has, for a decade, not surprised investors. Trading updates have varied from ‘mildly subdued’ to ‘a little enthusiastic’. Results have tended to be a little better than flagged, showing constant, incremental improvement. All of these little things have added up to an admirable track record.

Why is it Cheap?

The question you’re probably asking yourself is this: if I’m right, why is it so cheap? Why does it trade at less than half of the multiple of the other industrials I highlighted?

One answer is obviously size. The market doesn’t like small-caps at the moment.

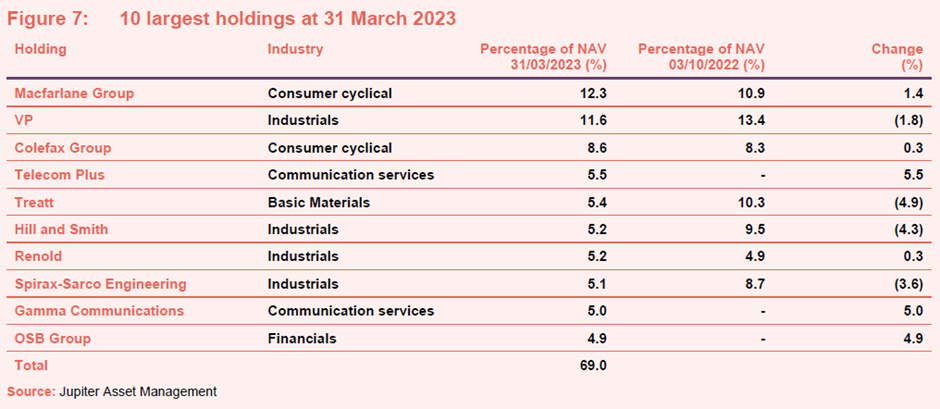

It can’t help, either, that the largest shareholder has openly flagged its intention to cut its position. Rights & Issues Investment Trust – which was a brilliant little vehicle employing conviction stockpicking of the kind you don’t really see any more in listed trusts – lost its long-standing manager and appointed Jupiter. There’s a nice commissioned piece talking through the portfolio here.

The holdings as at March look like this:

And when the accompanying commentary says things like:

RIII’s portfolio is currently undergoing a period of heightened turnover, as the Jupiter team adjusts it to reduce the significant overweight positions at the top of the portfolio

Macfarlane is a longstanding RIII holding which the manager intends to retain within the portfolio, although it expects to a smaller weighting over time.

… you know it’ll hardly be an auspicious time for the share price.

In truth, trying to speculate on why small cap prices move is a silly game, particularly in a market like this. Liquidity is very thin. Fund managers are, broadly, facing redemptions and not inflows. It sounds trite, but the truth really is that share prices go down when there are more motivated sellers and go up when there are more motivated buyers.

I continue to think Macfarlane will be trading, at some point, at a high-teens multiple. That will reflect the inherent quality of the business, the strength of management, and their well-executed organic and acquisitive growth strategy.

Calculated Stubbornness

I vividly remember writing about Judges Scientific on my previous blog in May, 2015. I said that I thought the shares – which were at £17 – could get to £40 in the next four years:

For what it’s worth, using assumptions I think are realistic but neither particularly aggressive or conservative, I think Judges can get to £40 a share within 4 years. The tail-end of that CAGR would give a ~24% return on my investment, as well as a percentage point or two of dividends annually.

And for those who don’t like all of the hypothesising above, think about it this way; you’re investing, alongside management, at ~11x EBIT, in a team with one of the best records of value creation on the London stock market.

I see it as an asymmetric bet; you’re buying a collection of underlying business with above market growth, above market returns and exceptional margins at a cyclically undemanding point. A mini – but better – Oxford Instruments – at a much cheaper multiple. This protects the downside of your distribution. The up case comes if management continue to create ongoing value from accretive acquisitions. Given everything I’ve said so far, I think the skew on this distribution is heavily in investors’ favour.

A lot of the pushback I got on that idea is similar to the pushback I get on Macfarlane today. How can something which acquires businesses at mid-single-digit EBIT multiples be worth more than that? How long is the runway for growth, really? Why should it be worth much more than its current multiple – what do you know the market doesn’t know?

Well, I didn’t know anything more than anyone else, but Judges is now worth £100/share. I’m not saying this to puff up my ego: I sold Judges way too early, and I’ve had plenty of investments which look nothing like as rosy as Judges.

But what I am saying is that everything that makes Judges a brilliant business today was just as evident when I wrote about it, when it was trading at less than the half the multiple. I wasn’t plucking some sunny story out of thin air. Judges, like Macfarlane, had a decade-long track record of double-digit earnings growth. It was executing the same strategy then as now. Very little changed: except for market perception.

Calculated stubbornness. That is, perhaps, what I should call my strategy. If you employ it in good businesses – growing businesses, which redeploy their capital well – you can be as patiently stubborn as you like. Eventually you and the market will agree on the valuation, and at that point you can gracefully bow out. Until then, you sit back, collect your dividends, and watch earnings grow.

It’s a pretty compelling argument Lewis and not one that I can easily argue against. Although the fact that the share price has gone absolutely nowhere in the last five years indicates that investors are uninterested in the company whatever its underlying performance.

The ongoing selling by RIII is a very clear and unhelpful headwind to the share price. It will abate in time but they’ve got quite the stake to reduce. The best outcome might be placing some of this with another fund manager but that’s beyond our control.

What we can do is identify stocks like this (arguably it’s something of a Zulu stock) and wait for a catalyst. Sooner or later something will happen and I’m betting that it won’t be a deterioration in the operational earnings.

Thanks Damian!

I don’t mind things that have gone nowhere – I’m not too picky. Not to overstretch the point, but Judges also had four ‘dead’ years from 2013 – 2017. Good companies sometimes have very long periods of readjustment or patches where they are out of favour. As long as the fundamentals are going in the right direction, you are just ‘tensioning the spring’ and it will catch up eventually.

Let’s see. I hope we’re not wrong – I have a large proportion of my money in it!

Thank you very much for all the information you share. I really like Macfarlane for all that you have exposed in your article. I wanted to ask you if you know the French distributor WE (ALWEC), it has grown revenue and EBIDTA AT 20% CAGR since 2016, has a very aligned board and is currently trading at 4-5x despite having signed a new agreement with a quite important customer such as HP which will allow them to reach their 2024 sales targets which means continuing to grow at double digit. I know you only invest in the UK but France is not far away.

Hi Pablo,

I actually don’t know ALWEC. The metrics look very nice at first glance. Unusually, it is also cheap on an asset basis: they carry a lot of working capital relative to gross profit, though that might be a presentation issue from my data provider.

I do know Thermador – a lovely French distributor – from a decade ago when I was looking at French names, but my job gives me a mandate to look only at UK names, so I don’t stray from these shores!

Best,

Lewis

¡Nice post! I’m studying the company now and I find some points similar to you. Nowadays the company is trying to expand the same method in Europe with some acquisitions.

Telling about acquisitions, I want you to know that the Directors are very careful with the EBITDA price.

In conclusion, I agree with many points that you mentioned and probably I will add to my portfolio.

Good job,

Gerard Martinez.